Paperless Transactions: The Future of ACH Payment Services

In today’s quickly-paced entire world, technology has significantly converted the way we conduct financial transactions. Probably the most effective options for businesses to receive monthly payments from consumers is by Programmed Removing House (ACH) dealings. ACH monthly payments are electronic exchanges of money between accounts, and they are getting to be ever more popular recently due to their speed, basic safety, and price-performance. In this post, we’ll investigate ACH payment services in depth, looking at how they function, what positive aspects they feature, and exactly how organizations can apply them into their payment functions.

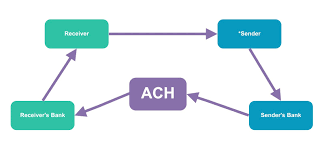

ach payment services are electronic moves of resources between banking accounts, which typically involve either a client or even a organization giving cash to another enterprise or supplier. The whole process of an ACH payment services are initiated with the sender from the payment, who creates an ACH submit that outlines the transaction particulars, for example the quantity, the receiver, along with other pertinent information and facts. As soon as the file is carried out, it really is published to the obtaining lender, which verifies the info and transmits the resources for the recipient’s account. This entire approach often takes someone to three enterprise time, which happens to be faster than conventional paper inspections.

One of the most considerable great things about ACH payment services will be the cost-effectiveness they have. Compared to credit cards, dealings fees are often much lower, rendering it an excellent option for small companies and business people who wish to save cash on settlement digesting costs. In addition, ACH transactions give you a lessened potential for fraudulence, because they require particular information and facts from the sender, including checking account and routing numbers.

An additional advantage of ACH payment services is they could be fully automatic, allowing you to improve your payment functions and boost your business’s efficiency. Instead of manually generating and mailing papers investigations or digesting visa or mastercard obligations, you can create ACH repayments to get automatically highly processed over a schedule that works for your business. This means you can concentrate on far more vital elements of your small business, like customer support, marketing, or item development.

Utilizing ACH payment services into your business is relatively easy. To get started, you’ll should create an account by having an ACH service provider, for example PayPal or Stripe. After you’ve established your bank account, you’ll should link it together with your bank account to allow electrical transfers. You may then integrate your ACH settlement services application with the existing repayment program, and you’re good to go.

Eventually, ACH obligations are getting to be ever more popular among consumers who demand easy dealings. Firms that offer ACH monthly payments as being an solution will likely see a rise in buyer preservation and pleasure, which can cause increased revenue and profits. Clients enjoy the safety and rate of ACH obligations, and lots of like them over paper checks or bank cards.

quick:

In summary, ACH payment services can help organizations improve their transaction processes, save money, and increase customer happiness. By being familiar with the advantages of ACH repayments, enterprises can much better get around the altering financial panorama and meet the demands of their clients. Whether or not you’re an entrepreneur only starting out or a well-set up organization planning to improve your transaction finalizing, ACH payment services are a fantastic option to think about. Be sure to research distinct ACH companies and locate the one that best suits you, and enjoy the great things about easy transactions.