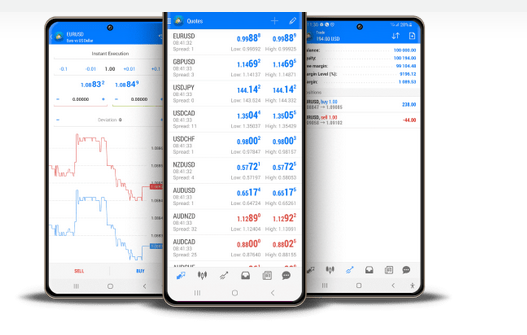

Metatrader 4 vs. cTrader: Which Platform to Choose

Metatrader 4, or MT4, is actually a popular electronic forex trading foundation utilized by an incredible number of traders globally. It can be readily available for liberated to download and is employed for investing economic equipment like currencies, stocks, and merchandise. The MT4 program can be tailored, and investors can use various tools and signals to assist them to assess the markets. In this particular complete manual, we shall cover everything you should know to learn Metatrader 4.

1. Knowing the MT4 Program

Step one to mastering MT4 is always to recognize its program. If you open the system, you will realize different windows and tabs. The “Market See” windows shows the various fiscal devices accessible for trading, as the “Navigator” window reveals your bank account details, indicators, and professional experts. The “Terminal” windows screens your open up transactions as well as your buy and sell history. You are able to modify these home windows by appropriate-simply clicking them and picking “modify.”

2. Including Custom made Signals

Signals are the best instruments designed for inspecting the trading markets, and MT4 has an array of built in signals. However, you may also put your own personal custom signs. To get this done, you should download the indicator code and save it to the “Indicators” directory inside the MT4 website directory. Once you have carried this out, you could add the indicator to the graph by simply clicking “Put” after which selecting “Indicators.”

3. Making use of Specialist Consultants

Specialist Analysts, or EAs, are programmed forex trading techniques that will implement investments based on predetermined criteria. To work with an EA, you first need to download or make 1. Upon having done this, you can add the EA for your graph by hitting “Navigator” and then picking “Specialist Experts.” You may then set the guidelines for your EA, including the whole lot dimensions, quit-reduction, and take-earnings levels.

4. Backtesting Your Technique

Before starting buying and selling with actual money, it’s important to backtest your technique. MT4 enables you to try this by utilizing the “Strategy Tester” function. To work with the Method Tester, you first need to pick the expert expert you want to examination after which establish the guidelines for the check. Upon having performed this, you can start the test and find out how your approach could have done in the past.

5. Positioning Trades and Controlling Threat

After you have backtested your approach and will be ready to commence forex trading with real cash, you need to know the way to position investments and deal with threat. To put a trade, first you need to select the financial tool you need to buy and sell after which simply click “New Get.” You can then established the good deal sizing, end-damage, and get-earnings levels. It’s vital to control your chance by environment proper stop-damage ranges and not taking a chance on more than within your budget to shed.

Bottom line:

In summary, understanding Metatrader 4 needs comprehending its user interface, incorporating custom indications, utilizing expert experts, backtesting your approach, and setting trades although controlling danger. By following the tips in this particular thorough manual, it is possible to become a productive MT4 investor. Always exercise good danger managing as well as to be patient, as mastering MT4 usually takes time and effort. With commitment and determination, you can achieve great success with Metatrader 4. Pleased forex trading!